are dental implants expenses tax deductible

As part of dental expenses there are also fillings dentures dental implants and other procedures which you cannot be covered for by your health plan. Your dentist would not implant them unless they were a medicaldental necessity even if the procedure was elective.

100 Tax Deductible Dentistry Trusted Advisor

1 Follow along as we break down the hidden features benefits and caveats for each of the three options and illustrate the potential savings.

. The good news is that will include all of your medical and dental expenses not just your dental implants. You can only deduct expenses greater than 75 of your income. This includes fees paid to dentists for X-rays fillings braces extractions dentures etc.

Deductible medical expenses are discussed. If youre wondering whether cosmetic surgery dental implants LASIK or other medical expenses are tax deductible the IRS has a document for you. You can include in medical expenses the amounts you pay for the prevention and alleviation of dental disease.

For details and a full list of tax-deductible medical expenses see IRS Publication 502 Medical and Dental Expenses. Are Dental Implants Tax Deductible. When you itemize the IRS allows you to deduct medical and dental expenses that exceed 75 percent of your adjusted gross income for tax year 2021.

To claim tax relief on non-routine dental expenses you must. Preventive treatment includes the services of a dental hygienist or dentist for such procedures as teeth cleaning the application of sealants and fluoride. Your dental implant expenses are tax-deductible in the United States per IRS guidelines clearly stating that payments made for artificial teeth qualify.

Cosmetic surgery includes any procedure that is directed at improving the patients appearance and doesnt meaningfully promote the proper function of the body or prevent or treat illness or disease. For instance if you had 3000 in dental expenses and made 20000 1500 of your expenses are deductible. The IRS states that the total paid for dental implants can be reported as a medical expenditure on Schedule A Itemized Deductions.

Dental implants are considered a medical expenses. Are dental implants tax deductible. The deduction is not automatically deducted however so you will need to itemize your deductions in order to claim it.

Any 7 should be remembered as a good thing. However if you have 3000 in expenses but earn 50000 none of your dental expenses. You should speak with Are Dental Implants Tax Deductible In Canada.

Employer-sponsored premiums paid under a premium conversion plan cafeteria plan or any other medical and dental expenses paid by the plan arent deductible unless the premiums are included in box 1 of your Form W-2 Wage and Tax Statement. You can deduct 5 of your gross income. It also explains Medical care expenses include payments for diagnosis cure mitigation treatment or prevention of disease or payments for treatments that affect the structure or function of the body.

Dental expenses includes fillings dentures dental implants and other dental work that is not covered by your insurance plan. For example if youre a federal employee participating in the premium conversion plan of the Federal Employee. Whenever you claim anything on as a deduction on your income tax you should always be sure to save your receipts and any other.

The good news is yes dental implants are tax deductible. Your dentist will normally give a Med 2 to you after your treatment. If you receive treatment over more than one year they must complete a separate Med 2 for each year.

Dental implants are tax deductible so thats good news. Are Dental Implants Tax Deductible. If you are 65 or over they are deductible to the extent they exceed 75 Please click here for more information.

The only exception is dental work that is purely cosmetic such as teeth whitening. Dental treatment including x- rays fillings braces. Have a Form Med 2 completed by your dentist.

Most dental expenses can be used as medical expense deductions when filing your income taxes in Canada including. The IRS explicitly states that expenses associated with cosmetic surgery including cosmetic dentistry are not eligible for tax deductions. The only dental work that is not covered is cosmetic work such as teeth whitening which is not deemed medically necessary.

Yes dental implants are an approved medical expense that can be deducted on your return. Replyyes they qualify after youve reached the 3 of your gross income. If your implant or cosmetic dentistry fee is 50000 then 45125 is fully tax deductible.

While dental implants arent specifically mentioned in IRS Publication 502 the IRS says. Vancouver dentists british columbia bc canada A dental implant is an artificial tooth root that is anchored in your jaw to hold a replacement tooth bridge or. You can include in medical expenses the amounts you pay for dental treatment.

Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI. Since the average middle class worker earns about 50000 a year you. A good things to remember is that anything 75 of your gross total income is tax deductible.

Lets say you make 40K a year. How to claim dental expenses. Yes dental implants are an approved medical expense that can be deducted on your return.

You would have to eat the first 3000 of those expenses before it starts lowering your tax obligation. There is a small catch though. A Strategy To Benefit From the Medical Expense Tax Break.

Yes dental implants qualify as a tax-deductible medical expense under current Revenue Canada guidelines. By taking this deduction on your tax return you receive a tax refund of. Medical expenses and dental care expenses can be deducted on a personal tax return in order to help offset the costs of these expenses.

If one or two crowns are placed to rehabilitate your bite due to an accident illness or disease they. Other dental work not paid by your insurance plan. Dental implants are tax deductible.

Dental Crowns Issues And Concerns Dental Health Society

What Happens When You Can T Afford Dental Care Wdg Public Health

Are Dental Costs Tax Deductible In Canada Cubetoronto Com

Perfit Are Denture Implants And Dental Implants A Cra Tax Credit

Dental Insurance Coverage And Cost Forbes Advisor

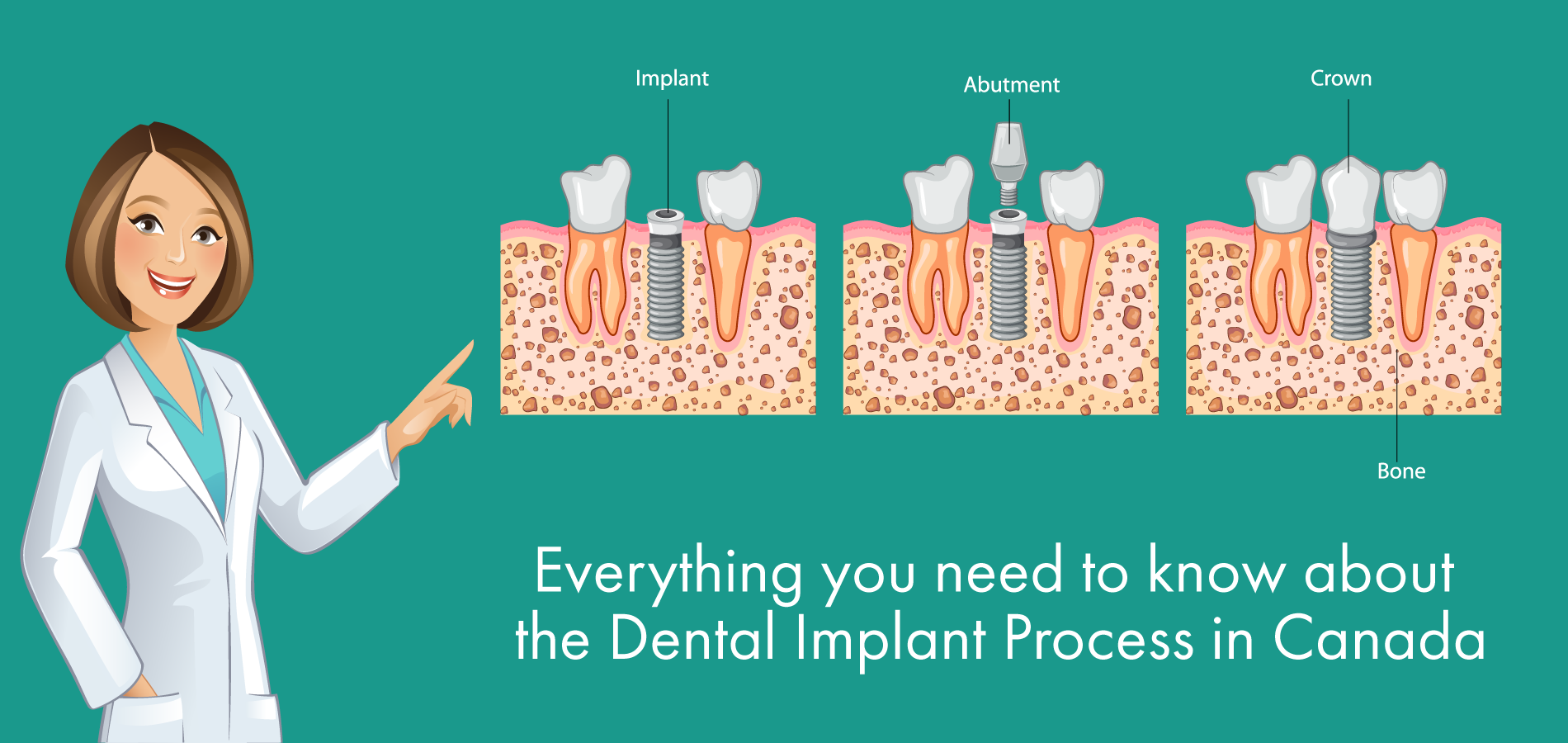

Everything You Need To Know About The Dental Implant Process In Canada

Dental Implant Cost Toronto How Much Do Dental Implants Cost

3 Common Ways Insurance Companies Deny Dental Claims Dentistry Iq

Your Guide To Dental Insurance In Ontario Guelph Dentist

Are Dental Implants Tax Deductible Drake Wallace Dentistry

Are Dental Veneers And Implants Tax Deductible

Are Dental Veneers And Implants Tax Deductible

Which Dental Expenses Are Considered Deductible Medical Expenses When Filing Income Taxes 2022 Turbotax Canada Tips

12 Easy Ways To Get Affordable Dental Implants In 2022 Authority Dental

3 Irs Dental Implant Discount Plans Tax Deductible Savings Dental Implants Irs Taxes Tax Deductions

Are Dental Implants Tax Deductible Atlanta Dental Implants

Wisdom Teeth Removal Cost How Much Are Wisdom Teeth Extraction 2021 Frisco Tx Highland Oak Dental